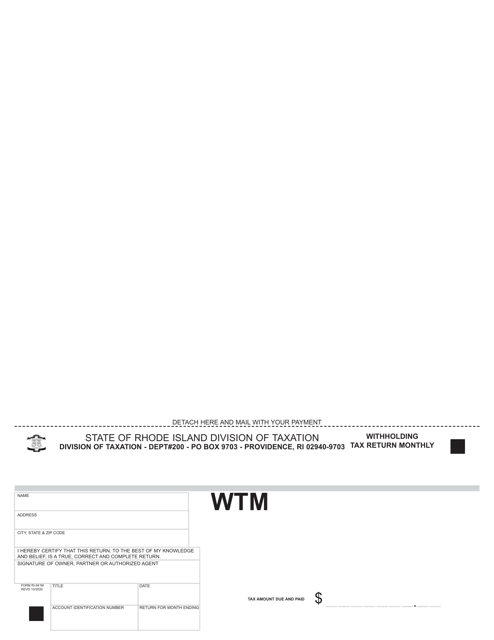

rhode island state tax withholding

In Rhode Island there are five possible payment schedules for withholding taxes. 8 rows 375.

Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf.

. Subtract the nontaxable biweekly Thrift. Daily quarter-monthly monthly quarterly and annually. Latest Tax News.

Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount. Federal Form W-4 can no longer be used for Rhode Island withholding purposes. PPP loan forgiveness - forms FAQs guidance.

Once you have completed Form RI W-4 for your employer Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or. Unlike the Federal Income Tax Rhode Islands state income tax does not provide couples filing jointly with expanded income tax brackets. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

255750 plus 475 of excess over 68200. Read the summary of the latest tax changes. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

Additionally employers in other states may wish to withhold Rhode Island personal income tax from wages of their Rhode Island employees as a convenience to those employees. A the employees wages are subject to Federal income tax withholding and b any part of the wages were for services performed in Rhode Island 280-RICR-20-55-106C1. Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

File Scheduled Withholding Tax Payments and Returns. A resident is defined as anyone who is domiciled in the state or who spends 183 days of a tax year in the state. REPORTING RHODE ISLAND TAX WITHHELD.

Since all of the gain is being taxed in the year of the sale for Federal purposes the withholding indicated was 6 x 108000 6480. 2022 Filing Season FAQs - February 1 2022. The income tax is progressive tax with rates ranging from 375 up to 599.

Ad Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now. Office of the Governor Secretary of State RIgov Elected Officials State Agencies A-Z State. An employer may withhold Rhode Islands personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding.

UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be calculated and withheld. WEEKLY - If the employer withholds 600 or more for a calendar month. Additionally employers in other states may wish to withhold Rhode Island income taxes from wages of their Rhode Island employees as a convenience to those employees.

Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis. Rhode Islands maximum marginal income tax rate is the 1st highest in the United States ranking directly below Rhode Islands. Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI and Rhode Island job development fund tax.

State of Rhode Island. RI Employer Tax Section 401-574-8700 Option 1 - unemployment and TDI. Masks are required when visiting Divisions office.

Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages. The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state. You must complete Form RI W-4 for your employers.

Thank you for using the Rhode Island online registration service. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. The Division reviewed the Election indicated the 6480 as the amount to be withheld on the RI 713 Certificate and returned the certificate to Martha.

RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration only questions. Your payment schedule ultimately will depend on the average amount you hold from employee wages over time. An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding.

Withholding Formula Rhode Island Effective 2022. State of Rhode Island. The income tax withholding for the State of Rhode Island includes the following changes.

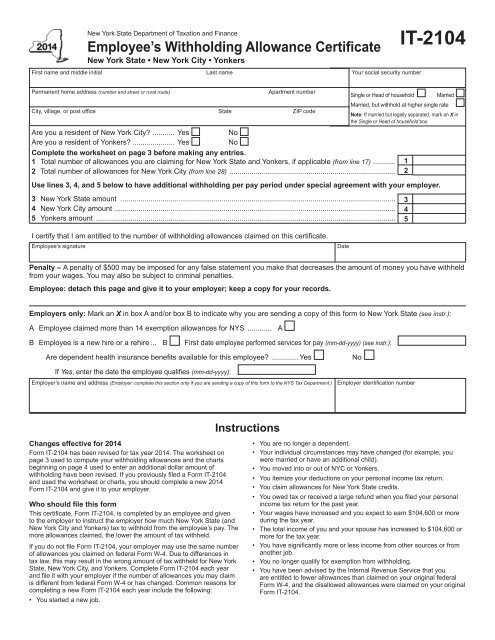

State of Rhode Island Division of Taxation Employees Withholding Allowance Certificate. Withholding Tax Forms. Over 68200 but not over 155050.

5 rows Withholding Formula Rhode Island Effective 2021. All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format To have forms mailed to you please call 4015748970 Withholding tax forms now contain a 1D barcode. Ad Fill Sign Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

Form Ri 941m Download Fillable Pdf Or Fill Online Withholding Tax Return Rhode Island Templateroller

Tax Day Laggards Consider Filing For Extension If In A Rush Djournal Com

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Irs Form 945 How To Fill Out Irs Form 945 Gusto

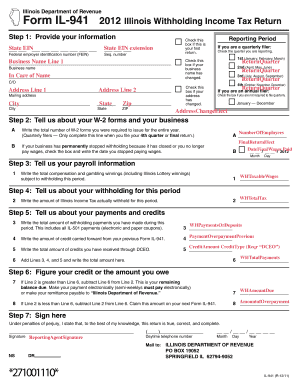

Fillable Online Tax Illinois Tax Withholding Form Fax Email Print Pdffiller

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

Form It 2104 New York State Tax Withholding South Colonie

Improved Tax Withholding Estimator Now Available Pg Co

Ri Ri W 4 2020 2022 Fill Out Tax Template Online Us Legal Forms

New W 4 Irs Tax Form How It Affects You Mybanktracker

State W 4 Form Detailed Withholding Forms By State Chart

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

State W 4 Form Detailed Withholding Forms By State Chart

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Tax Withholding For Pensions And Social Security Sensible Money